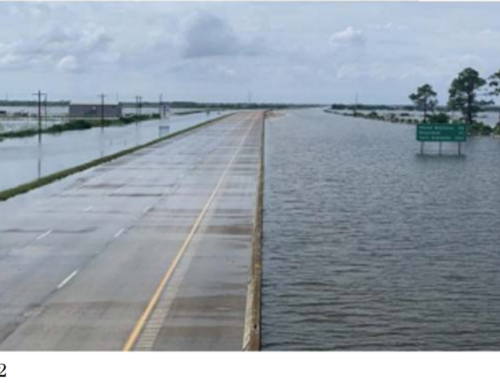

In 1992, the NCDOT filed such a map for a project to build an interstate loop around Fayetteville. The proposed project is illustrated in the image below, from the NCDOT site that describes the project:

Under the Map Act, the landowners were prohibited from subdividing the 0.58 acres within the project area or doing anything on that land or to their home that would require a building permit without NCDOT’s approval. The landowners still lived in their home and could sell it, but any purchaser would take the land subject to the restrictions imposed by the Map Act. Fourteen years later, in 2006, a second map was filed that expanded the property subject to the restrictions by an additional 1.67 acres.

The landowners filed an inverse condemnation claim in December of 2014. They claimed that the filing of both the 1992 and 2006 maps constituted a taking of their property without the payment of just compensation. At trial, the landowners’ appraiser testified that the subject property was worth $144,888 before the filing of the first map in 1992 and was worth only $7,641 after the filing of the map. He further opined that the property subject to the second map filed in 2006 was worth $11,268 before the filing and was only worth $5,129 afterward. An expert real estate broker who testified for the landowners stated that there was no market for properties subject to Map Act restrictions because there were plenty of alternative properties in the area that were unencumbered. This reinforced the appraiser’s testimony that the filing of the map deprived the property of most of its value.

The condemning authority had not put on any evidence at trial because the trial court excluded its expert’s testimony. The condemning authority’s appraiser had first offered an opinion about the value of the restrictions on the property, which he characterized as a negative easement, for a three year period. He arrived at three years because, under the Map Act, a property owner could file a subdivision plat or an application for a building permit with the NCDOT, which would then have a three-year period in which to either approve the proposal or proceed to acquire the property outright. On that basis, the appraiser for the government had calculated the value of the two takings to be $12,425. Once the trial court ruled that the Map Act restrictions were indefinite, the appraiser revised his opinion upward to $22,300. He drew a comparison between the indefinite restrictions imposed by the Map Act and the restrictions on properties located within a flood plain and used sales of such properties as comparable sales to determine the fair market value. However, the trial court still excluded the opinion. It specifically noted that the comparable properties chosen were far removed from the subject property and there was no reliable way to analogize the restrictions to flood plain restrictions. The trial court also excluded any evidence about the value of the property from the landowners’ continued residence in the home up to 2016.

The Supreme Court of North Carolina upheld these evidentiary rulings, finding that the trial court did not abuse its discretion in excluding the state’s appraiser’s testimony. It also upheld the exclusion of evidence about the value the Chappells derived from continued residence on the property, noting that, although such evidence could have been relevant and admissible had the condemning authority’s appraiser used the income capitalization approach to value the property, he had only used the sales comparison approach.

In the end, the trial court awarded the property owners what was essentially the fair market value of the fee simple interest in the property encumbered by the Map Act restrictions. The Supreme Court of North Carolina upheld this award because of the landowners’ evidence that the property had essentially no market value.

The case while largely unhelpful to condemning authorities, did contain at least a small bit of useful material for condemning authority counsel. The high court remanded the case to the trial court because the trial court had awarded compound interest instead of simple interest.

Given that the intent of the Map Act was actually to reduce – not increase – the cost of highway construction projects, nobody except perhaps landowners’ counsel should grieve that it was repealed by the N.C. legislature in 2019. The opinion is Chappell v. North Carolina Department of Transportation and can be found here.

[EDITOR’S NOTE: If you were questioning like we were how a 22 year old claim managed not to be time barred, the opinion does not address it, but it may be that North Carolina has an inverse condemnation statute of limitations specific to the Department of Transportation that reads in part “Any person whose land or compensable interest therein has been taken by an intentional or unintentional act or omission of the Department of Transportation and no complaint and declaration of taking has been filed by said Department of Transportation may, within 24 months of the date of the taking of the affected property or interest therein or the completion of the project involving the taking, whichever shall occur later, file a complaint …” N.C. G.S. 136-111. The Fayetteville Outer Loop is under construction with the project completion date shown as 2026.]

Matt Hull is a Pender & Coward attorney focusing his practice on eminent domain/right of way, local government, and waterfront law matters.

Leave A Comment